Activity (Page 102)

Activity: Use table I and write the appropriate amount/figure in the boxes for the example given below:

Solution:

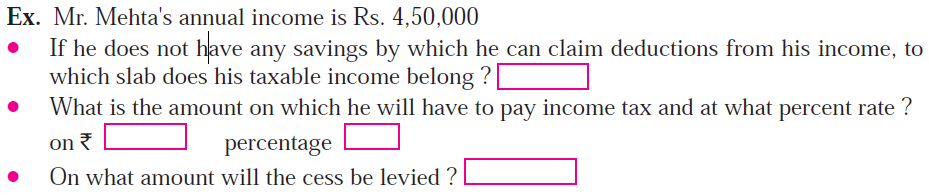

Ex. Mr. Mehta's annual income is Rs. 4,50,000

- If he does not have any savings by which he can claim deductions from his income, to which slab does his taxable income belong? ₹ 2,50,001 to ₹ 5,00,000

- What is the amount on which he will have to pay income tax and at what percent rate?

On ₹ 2,00,000 at percentage 5%

i.e. Income Tax = ₹ 10,000 - On what amount will the cess be levied? ₹ 10,000

This page was last modified on

21 January 2026 at 23:39