Activity (Page 103)

Activity: Use table II to carry out the following activity:

Solution:

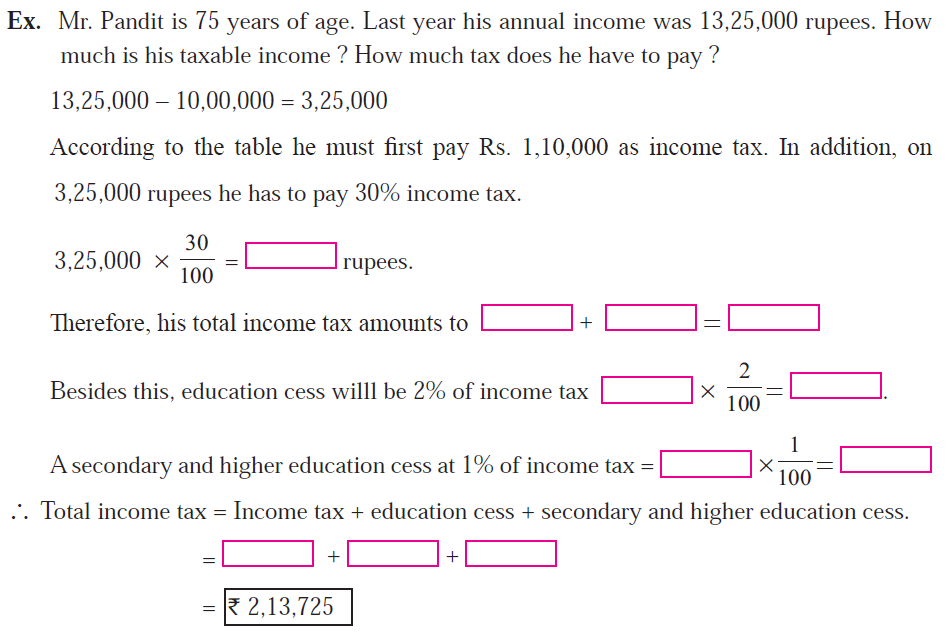

Ex. Mr. Pandit is 75 years of age. Last year his annual income was 13,25,000 rupees. How much is his taxable income? How much tax does he have to pay?

Since Mr. Pandit is a senior citizen (age more than 60 years), we refer to Table II (Textbook page 103).

13,25,000 - 10,00,000 = 3,25,000

According to the table he must first pay Rs. 1,10,000 as income tax. In addition, on 3,25,000 rupees he has to pay 30% income tax.

30% of 3,25,000 = \(325000 \times \displaystyle \frac{30}{100} =\) ₹ 97500

Therefore, his total income tax amounts to 1,10,000 + 97500 = ₹ 2,07,500

Besides this, education cess willl be 2% of income tax 2,07,500 × 2/100 = ₹ 4150

A secondary and higher education cess at 1% of income tax = 2,07,500 × 1/100 = ₹ 2075

∴ Total income tax = Income tax + education cess + secondary and higher education cess.

= 2,07,500 + 4,150 + 2,075

= ₹ 2,13,725

This page was last modified on

21 January 2026 at 22:44